Table of Contents

The Australian property market is dynamic and influenced by numerous factors that cause property values to fluctuate over time. Understanding these factors can help investors make informed decisions and optimize their returns. This guide will explore why property values increase in both the short and long term, the ‘wealth effect,’ and how to choose investments that outperform market averages.

Understanding Property Cycles

How Does a Property Cycle Work?

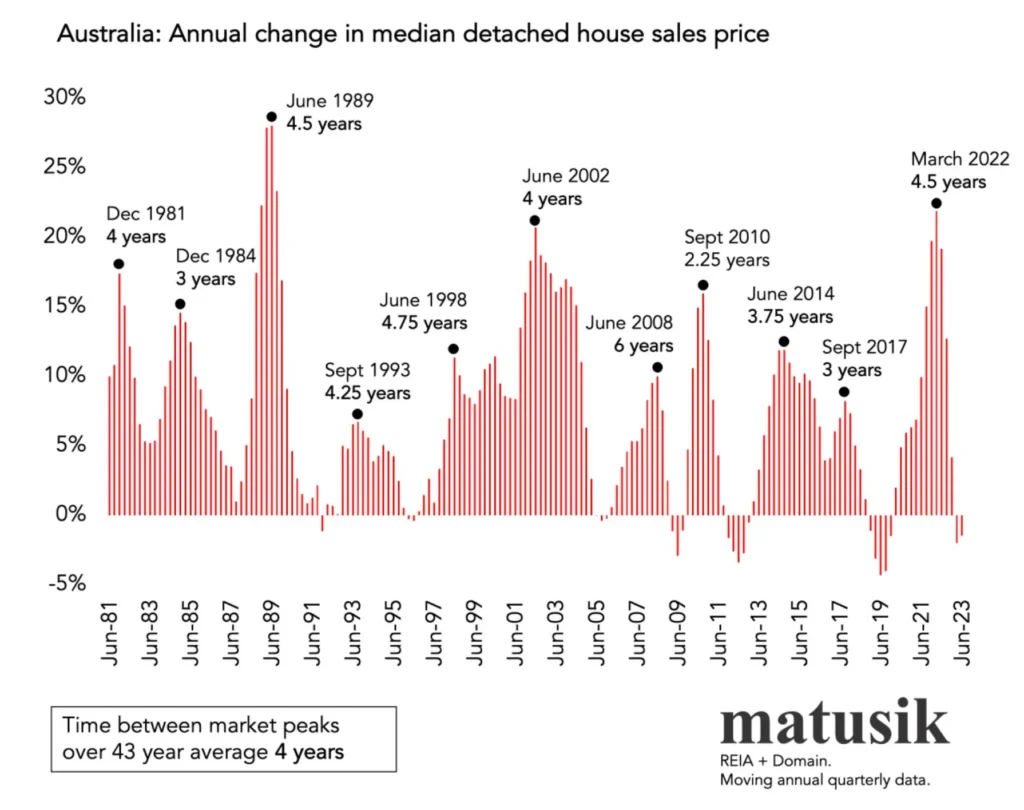

Australia’s property market moves in cycles, influenced by economic factors, supply and demand, and consumer confidence. Typically, a property cycle begins with rising values, followed by a period of stagnation or decline, before rising again. While the overall Australian property market peaks every four years, individual state cycles can vary, often taking longer to peak and followed by flat growth periods.

The Property Boom of 2020-21

The pandemic years of 2020-21 saw an unprecedented property boom. Driven by historically low-interest rates, pent-up demand, and government incentives, nearly 98% of locations in Australia experienced an increase in median property values, with many areas surging by over 20%. The total value of Australia’s properties skyrocketed to $9.9 trillion in 2021 alone.

Downturn Phase of 2022

The boom was short-lived. By 2022, affordability issues caused the market to cool down. Property prices surged by around 26%, outpacing wage growth, which rose a mere 2.3%. Soaring inflation further compounded the issue, making it difficult for buyers to save for deposits.

Market Reset of 2023

Early 2023 saw a market reset. Despite rising interest rates, property values began to climb again. The surge in migration and the return of international students drove demand, while supply lagged, leading to higher rents and property prices. Australia’s population grew by 620,000 people in the past financial year, the highest number in history.

Short-Term Factors Driving Property Values

1. Economic Growth and Stability

Economic growth boosts employment and wages, leading to higher disposable incomes and increased demand for property. Stable economic conditions create a favourable environment for property investments as consumers feel confident in their financial future.

2. Low-Interest Rates

When interest rates are low, borrowing becomes cheaper, encouraging more people to take out mortgages. This surge in demand drives up property prices. Monitoring interest rate trends can help investors time their purchases for maximum benefit.

3. Government Policies and Incentives

Government initiatives, such as the First Home Owner Grant and stamp duty concessions, can stimulate the property market by making it easier for buyers to enter. Understanding these policies can provide strategic advantages in the property market.

4. Infrastructure Developments

New infrastructure projects, like roads, public transport, and schools, make areas more accessible and desirable. These improvements can significantly boost property values, making it worthwhile to monitor planned developments in your target areas.

5. Population Growth

An increasing population, driven by natural growth and immigration, creates more demand for housing. High population growth areas often experience rising property values as the need for housing outstrips supply.

6. Supply and Demand Imbalances

When demand for housing exceeds supply, property prices rise. Investors should look for markets where the housing supply is constrained by geography or planning regulations to capitalize on this imbalance.

7. Market Sentiment

Consumer confidence and market sentiment play a crucial role in property prices. Positive sentiment can drive more people to buy, increasing demand and prices. Staying informed about market trends and consumer behaviour can help investors anticipate price movements.

8. Foreign Investment

Foreign investors, particularly from countries like China, have been significant drivers of property demand in Australia. When regulations are relaxed, an influx of foreign capital can drive up property values, whereas stricter controls can dampen the market.

Long-Term Factors Influencing Property Values

1. Sustained Economic Growth

Long-term economic growth leads to increased employment, higher wages, and more disposable income, which enhances the ability of people to buy properties, thereby driving up demand and prices over the long term.

2. Consistent Population Growth

Australia’s steady population growth, driven by natural increase and immigration, consistently adds to housing demand. As more people need homes, the pressure on the existing housing supply increases, leading to higher property values.

3. Major Infrastructure Development

Significant infrastructure projects like new roads, public transport links, schools, and hospitals make areas more desirable to live in. These developments can significantly boost local property values as they improve accessibility and livability.

The ‘Wealth Effect’ Explained

The ‘wealth effect’ refers to the phenomenon where people feel wealthier when the value of their assets, such as real estate, increases. This perceived increase in wealth can lead to more spending and investment in the property market, further driving up prices.

Strategies for Choosing High-Performing Investments

- Conduct Thorough Research: Utilize comprehensive market insights to identify high-growth suburbs. Check out our market insights for the latest data.

- Prioritize Location: Focus on areas with strong economic prospects, good infrastructure, and high population growth.

- Select the Right Property Type: Choose properties that are in demand, such as family homes with good amenities and access to schools and transport.

- Monitor Future Developments: Keep an eye on future infrastructure projects that could boost property values.

- Seek Expert Advice: Consider hiring a buyer’s agent to help navigate the complexities of the market and negotiate the best deals.

Preparing for Market Fluctuations

- Diversify Investments: Spread your investments across different property types and locations to mitigate risk.

- Stay Informed: Regularly update your knowledge of market trends and economic indicators.

- Adopt a Long-term Perspective: Focus on long-term growth rather than short-term gains.

- Maintain Financial Preparedness: Ensure you have a financial buffer to manage through downturns without being forced to sell.

- Engage Professional Management: Hire professional property managers to maintain and enhance the value of your investment.

Identifying Investment Hotspots

Research and Analysis

1. Leverage Comprehensive Data

Utilize data analytics tools to identify emerging investment hotspots. Websites like CoreLogic and Domain offer detailed market reports and insights that can help pinpoint suburbs with strong growth potential.

2. Understand Local Market Dynamics

Each suburb has unique characteristics that influence its property market. Look at factors such as median property prices, rental yields, vacancy rates, and demographic trends. For instance, areas with a high percentage of young professionals or families might offer better rental yields and capital growth prospects.

3. Government and Infrastructure Projects

Keep an eye on government policies and infrastructure developments. Projects like new transport links, shopping centres, and schools can significantly enhance the appeal of a suburb. For example, the planned Sydney Metro West project is expected to boost property values in the suburbs along its route.

Evaluating Specific Properties

Detailed Property Analysis

1. Inspect the Property

Conduct thorough inspections to assess the condition of the property. Look for signs of wear and tear, structural issues, and potential maintenance costs. Hiring a professional inspector can provide a detailed report and help you make an informed decision.

2. Analyze Comparable Sales

Examine recent sales of similar properties in the area to gauge the market value. Websites like realestate.com.au and allhomes.com.au provide sales history data that can help you compare prices and identify trends.

3. Rental Income Potential

Assess the potential rental income by looking at comparable rental properties in the area. Consider factors like proximity to amenities, transport links, and employment hubs. Tools like SQM Research offer detailed rental data and forecasts.

Maximizing Investment Returns

Strategic Investment Planning

1. Diversify Your Portfolio

Spread your investments across different property types and locations to mitigate risks. Diversification helps protect your portfolio from market fluctuations and ensures more stable returns.

2. Adopt a Long-Term Perspective

Property investment is a long-term game. Focus on long-term capital growth rather than short-term gains. Properties in high-growth areas might take time to realize their full potential, but patience often pays off.

3. Improve Property Value

Enhance the value of your investment through renovations and upgrades. Simple improvements like fresh paint, modern fixtures, and landscaping can significantly increase property appeal and rental income.

4. Monitor Market Conditions

Stay informed about market trends and economic indicators. Regularly review your investment strategy and adjust based on current conditions. Subscribe to market reports and newsletters from reputable sources to stay updated.

5. Professional Property Management

Hire a professional property manager to handle day-to-day operations, tenant issues, and maintenance. A good property manager can maximize your rental income, reduce vacancy rates, and ensure your property is well-maintained.

Preparing for Market Fluctuations

Risk Management Strategies

1. Financial Buffer

Maintain a financial buffer to cover unexpected expenses and downturns. Having reserves ensures you won’t be forced to sell at a loss during market downturns.

2. Insurance Coverage

Ensure your property is adequately insured. Comprehensive coverage protects against risks like damage, theft, and liability, safeguarding your investment.

3. Stay Informed

Continuously educate yourself about the property market. Attend seminars, read books, and follow industry experts to enhance your knowledge and stay ahead of market trends.

4. Network with Experts

Build a network of real estate professionals, including agents, brokers, and financial advisors. Their expertise and insights can help you make informed decisions and avoid common pitfalls.

Conclusion

Navigating the Australian property market requires a strategic approach, informed decision-making, and continuous learning. By understanding market cycles, identifying high-growth areas, and implementing effective investment strategies, you can optimize your returns and achieve long-term financial success.

For further insights and expert advice, explore our investment resources and consider consulting with one of our experienced property advisors.

Internal Links Used:

- CoreLogic

- Domain

- realestate.com.au

- allhomes.com.au

- SQM Research

- Investment Resources

- Property Advisors

This is not financial advice!

Leave a Reply